Concept of housewarming, real estate, new home – Young man holding key of new house

Recent statistics suggest that one-third of Canadians refer to themselves as “house poor.” Further, one-fifth say they regret their purchase.

To prevent falling into either of these situations, it is important to understand and avoid some common home buying mistakes.

A home is a life-changing purchase, and a very large one at that. It is helpful to take additional time and think through the process.

When considering options for homes in the York Region, you may wonder what some common mistakes people make. Keep reading, and you will be up to speed in no time.

Mistake 1. Not Working With a Real Estate Agent

Whether you are single or looking at family homes, the best advice Lina and Team can give you is not to go at it alone. It may seem like you are cutting costs by doing everything yourself, but in the end, the opposite is true.

If you are not an expert real estate agent and don’t possess the valuable network of industry professionals as they do, you could end up with several unexpected dilemmas throughout the home buying process. Problems almost always mean more expenses.

A good real estate agent helps with everything from beginning to end, including inspection reports and legal contracts. It can all get very complicated very quickly, so it pays to have an advocate on your side throughout the entire process.

Mistake 2. Skipping a Home Inspection

Searching for a home is synonymous with sentimental value. You are choosing a home where you can live out your dreams. Unfortunately, your feelings can stop you from thinking practically and objectively.

Homes can look great on the outside, but that does not mean they are without problems on the inside. Common concerns can include problems with the HVAC system, plumbing issues, and foundation cracks. You need an expert to evaluate the property so that you can make a rational, informed decision about the home you wish to purchase.

Mistake 3. Looking Before Being Fully Approved for a Mortgage

You may believe that you are a suitable candidate for a mortgage, but believing is not seeing. You need proof.

Financial institutions have a lot of factors to consider when evaluating if they will do business with you. This includes how much they approve you for.

Nothing hurts more than finding and falling in love with your perfect dream home and not being able to purchase it. Situations like this are a disappointment for both the buyer and the seller and are easily avoidable when starting the search fully prepared.

Before you look at homes, get mortgage approval.

Mistake 4. Not Talking to More Than One Lender

Not all mortgage lenders are the same. Rates can vary, terms can vary, as well as many other nuances.

Customer service is important, too. What if you have a question about your loan? What if your bill did not arrive in the mail on time and you want to make an overnight payment?

You want a lender who puts the customer first and answers questions in a timely, respectful manner.

Mistake 5. Opting Out of Mortgage Insurance

Incurring damage to your credit and adding potential debt is a serious potential consequence of opting out of mortgage insurance. To prevent unfortunate and needless losses, it is important to get mortgage insurance. What’s more, Mortgage insurance provides you with more flexibility in financing options.

Plus, it makes equity available to pay off the debt. This could be the most expensive purchase you make throughout your lifetime. Protect it with mortgage insurance.

Mistake 6. Not Putting 20% Down

The most attractive customer to a mortgage lender is one with 20% to put down. Buyers with a 20% downpayment ready to go appear more financially stable to sellers because their chances of mortgage approval are higher than buyers with lesser downpayment abilities.

Further, you will feel better about your purchase, knowing that you have money already down in your home.

As exciting as home buying is, be sure you are ready for the commitments involved.

Mistake 7. Draining Your Savings

Yes, you want to put 20% down, but that doesn’t mean you should use all the money you have. Emergencies happen, and with household emergencies, that can be costly.

It is important to remember that emergencies can often go beyond home repair. Car troubles, medical bills, unexpected childcare, and more are all types of financial emergencies.

It is important when you buy a home to have an emergency fund so your savings aren’t drained.

Mistake 8. Lack of Research

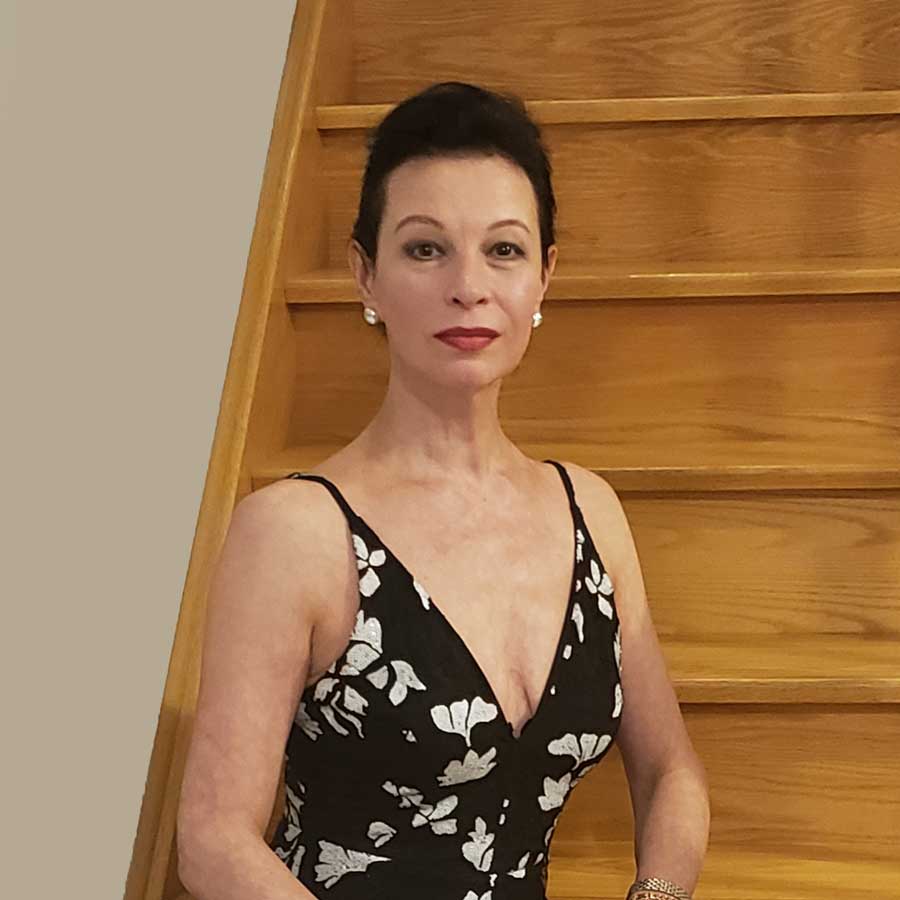

There are multiple things to consider when researching a real estate agent. The first thing to do is find the best real estate agent in town, such as Lina and Team in York Region, Ontario. Next, find out more information about things such as their services, experience and fees. Once you are clear that you understand the terms, remember to ask around and look for honest reviews online about your agent.

Once you are committed to an agent, think about what you need and what you don’t need. As you research, consider your budget. Have a price in your head of how much you want to pay and stick with it.

You could fall in love with the very first home you see or a home that is out of your price range. Keep searching and make a well informed decision when the time is right. Comparing home prices, considering the number of bedrooms, bathrooms, garage space, and everything else is super important before making your final decision.

Avoid These Home Buying Mistakes

A new home should be a time of bliss, not regrets. Do as much as you can to avoid the common home buying mistakes.

When you are ready to find your perfect home in York Region, you want to work with the best real estate agents there are Contact Lina & Team. They have superior marketing solutions, pay close attention to detail, and are able to expertly negotiate to get you into the home of your dreams!

Contact Lina & Team now!